Money-Mind 101™ Financial Tutoring

Mastering Money Management

An assessment of the family’s money behavior and history is the first order of “business.” How money matters are discussed and processed in the family are explored, especially in terms of parental money management style and expectations. How the children perceive, feel about, and understand money is studied. Surveys and customized data gathering techniques are utilized. All information is treated as confidential and privileged, and appropriate documents are signed prior to the initiation of the tutoring paradigm.

How money is earned, thought about, felt about, and managed is family, culture, and class specific. Families handle money differently across a variety of dimensions. Expectations and management styles vary as does taste, values, spending behavior, status needs, valuation, self-esteem, world-view, and pride. All of these factors interact with the family’s asset base. How this happens is explored in the tutoring process. This is always exciting and interesting for families. Novel discoveries are made, and a much more sophisticated appreciation and understanding of money is achieved.

The parents are worked with as a unit as are the children, and conjoint tutoring sessions are also conducted with the whole family. Important concepts which are studied and treated, within an overall educational framework, include the following:

1. Analysis of what money is, what it can do, how it is earned, and how it is dispersed

2. How family members feel and think about money, and their capacity to respect money

3. “Love & Money;” these dynamics are critically important in the family

4. Whose money is it anyway? Differential perceptions among family members

5. Money management techniques and strategies

6. Money and valuation (desires v needs)

7. Spending behavior and “entitlements”

8. Money and self-esteem

9. Money and power

10. Money and control

11. The temptations of elitism & materialism

12. Each family member’s contribution to the family unit

13. Chores, responsibilities, jobs, work ethic

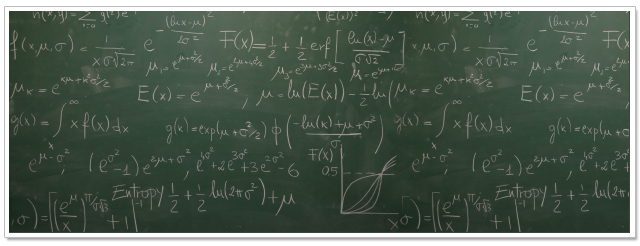

14. Money behavior & “brain chemistry:” always a lively topic/research findings

15. Budgeting: this is an interesting process. The Money Mind Budget Tracker is utilized as an initial tool with family members. The results are always intriguing as family members start to understand “what comes in, and how it goes out.” Many epiphanies are generated by this process!

The final phase of the program involves intervention and training which is determined by the assessment procedures outlined above. Each family’s tutorial program is structured based on empirical findings, and the clinical data generated from the assessment and education phases.